- Exponential Edge

- Posts

- Why You Don't Own Enough Assets

Why You Don't Own Enough Assets

Gold and silver are reminding everyone what happens when cash loses purchasing power.

Disclosure: This newsletter is for informational purposes only and does not constitute financial advice. Always DYOR before making any investment.

Each week in Edge, we share data-driven insights, highlight interesting risk ratings, and showcase our latest product updates.

Let’s dive in 👇

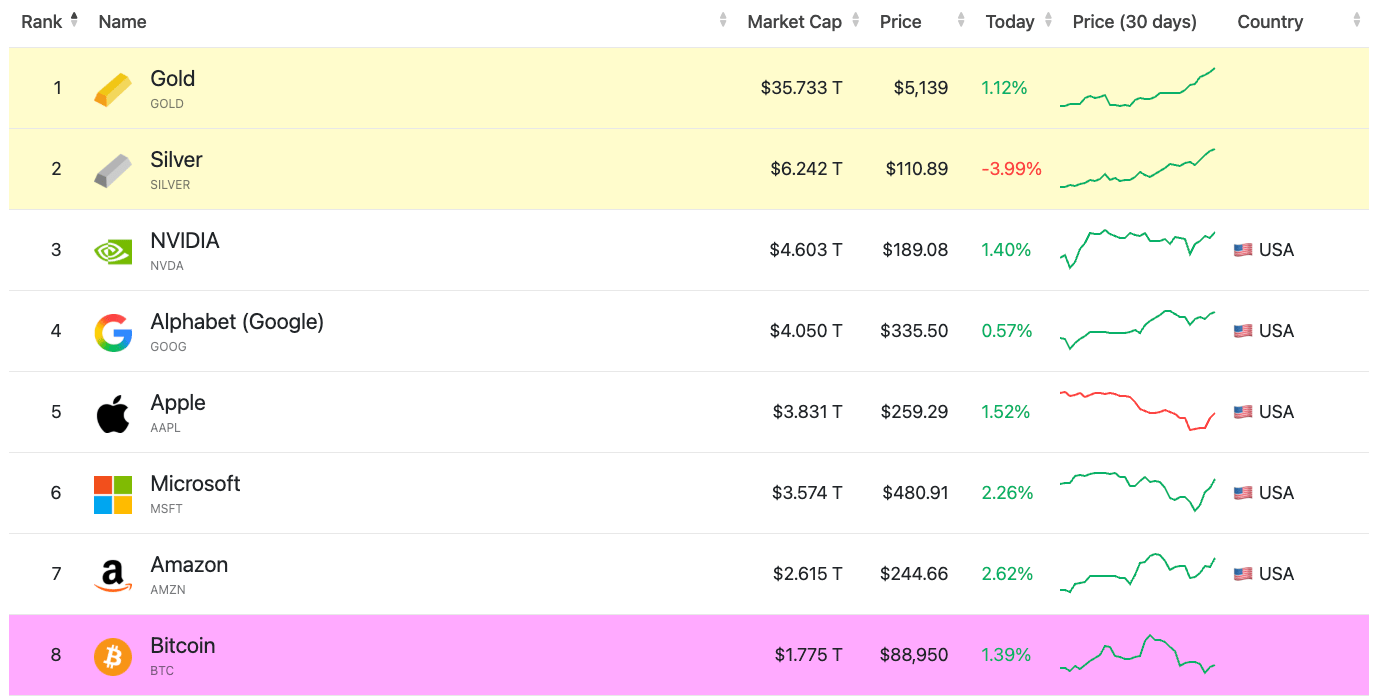

The Flight to Hard Assets

Precious metals are stealing the show this month. Gold just broke $5,100/oz, hitting fresh all-time highs, while silver vaulted past $100/oz, which sounds normal until you realize these are the two largest assets on earth by market cap. Moves like this aren’t just another “trade”, they’re a signal about where the marginal dollar wants to park when things feel unstable.

What’s fueling the rally? Part of it is simple risk-off behavior. When the world feels chaotic, gold remains the go-to safe haven for conservative capital. But a deeper, structural shift is also at work. Central banks and nations are steadily accumulating gold reserves at the expense of U.S. dollars, a quiet but accelerating trend that only becomes obvious in hindsight. When fiat purchasing power erodes month after month, holding cash starts to feel like a losing proposition and owning tangible assets shifts from optional to essential.

With gold and silver already ripping through 2025 and into early 2026, the current setup could eventually favor a rotation back into crypto. When the market sentiment shifts and starts seeking upside again, that’s when crypto can quickly go from “dead” to “too late”. You don’t need perfect timing. Just don’t be all-in cash while everyone else is getting long real assets.

Worth noting: this gold bid is also moving onchain, where tokenized gold has quietly grown into a meaningful position. If you need help deciding between tokenized gold vs Bitcoin, take a peek at YO’s breakdown below.

USD and ETH yields continue to rise

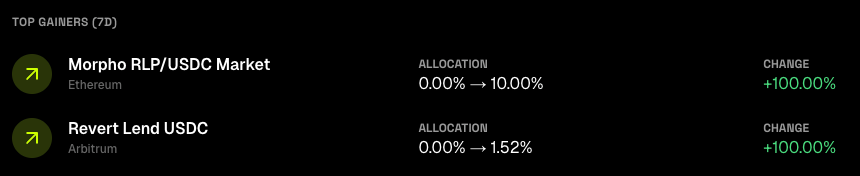

yoUSD: 🆕 yield source + first Arbitrum deployment. The vault is now lending USDC directly to Morpho borrowers paying 8%+ to loop RLP. Notably, yoUSD added its first pool on Arbitrum, starting with Revert Lend, where the vault is lending USDC against Uniswap V3 LP positions.

Want to see it in action? Check out the yoUSD vault’s recent rebalancing activity.

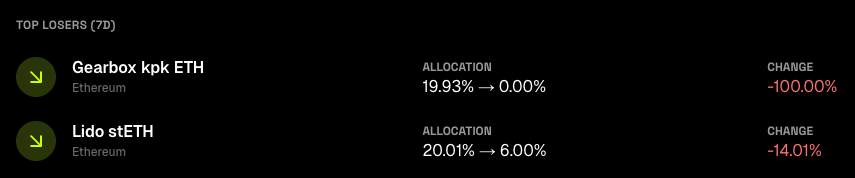

yoETH: 🔻 rotated out of Gearbox. With the majority of ETH yields still compressed, the optimization engine exited out of Gearbox kpk ETH, as rewards fell and were no longer competitive (sitting slightly above ETH staking yields).

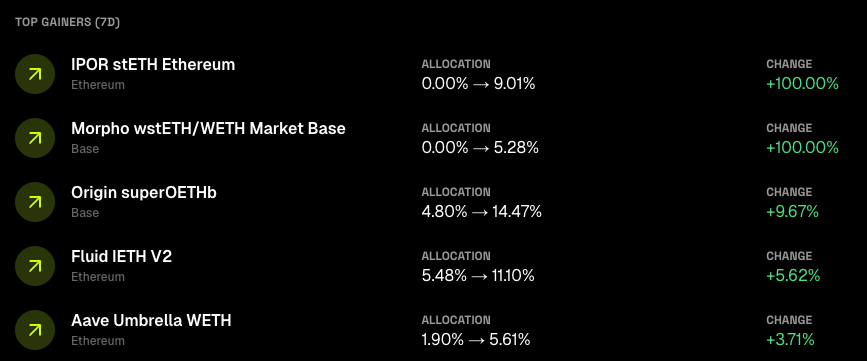

🔺 increased allocation into Aave Umbrella WETH. One source of rebalancing was to Aave Umbrella, where depositors earn underlying lending yield plus earning additional rewards for securing the protocol against bad debt. The vault also kept a strong tilt toward looping strategies (IPOR stETH Ethereum and Fluid iETH v2) to capture outperformance from leveraged stETH yield.

Some alfa in the latest edition of YO FLOW WEEKLY…👀

Vaults will serve as the infrastructure for TradFi to move onchain and earn yield.