- Exponential Edge

- Posts

- The fall of DeCeFi vaults

The fall of DeCeFi vaults

What Stream’s collapse tells us about the limits of transparency and trust in DeFi

Hey Edge readers,

A new class of DeFi “yield vaults” has emerged this cycle with hundreds of millions in TVL and advertising double-digit, “market-neutral” returns. Names like YieldFi (yUSD/vyUSD), Stream Finance (xUSD), mHYPER, deUSD and others are pitching themselves as the next evolution of onchain asset management.

But as users started digging in, a very different picture started to emerge: a small cluster of protocols lending to each other in circles, boosting each other’s TVL and APY, while leaving retail depositors holding most of the risk.

It’s starting to look a lot like a new version of the CeDeFi days with BlockFi and Celsius operating with black-box strategies. This time we just slapped a contract on it and spun it as “DeCeFi”, decentralized execution with CeFi-style opacity. Oh boy.

Stay sharp. 🫡

-The Exponential team

The “Daisy Chain” Yield Game

Disclaimer: This content should not be taken as financial advice. Always do your own research before making any investment decisions.

Yesterday, the worst-case scenario for DeFi’s new cycle of “yield superapps” finally hit. Stream Finance, one of the larger names in the space, disclosed that an external fund manager overseeing its assets had lost roughly $93 million. Stream has since halted all deposits and withdrawals, frozen pending transactions, and hired Perkins Coie LLP to conduct an investigation.

Yesterday, an external fund manager overseeing Stream funds disclosed the loss of approximately $93 million in Stream fund assets.

In response, Stream is in the process of engaging Keith Miller and Joseph Cutler of the law firm Perkins Coie LLP, to lead a comprehensive

— Stream Finance (@StreamDefi)

3:55 AM • Nov 4, 2025

This collapse is a turning point, and a warning shot for the entire class of high-yield “DeCeFi” vaults that built yield on top of recursive exposure.

The pitch from these vaults sounds straightforward: you deposit USDC, receive a yield-bearing token (e.g. yUSD, xUSD, or deUSD) that promises 10-20% APY under the banner of “market-neutral” or “delta-neutral” yield. What’s not obvious is where that extra 5-10% yield is coming from. Much of it is derived from the same capital being reused, re-pledged, re-lent, looping through multiple protocols.

This loop is what critics call the “daisy chain.” A user deposits USDC into Vault A and receives yUSD. Vault A then posts that yUSD as collateral on a lending market to borrow more USDC. The borrowed USDC is deposited into Vault B, which mints xUSD. Vault B uses its xUSD as collateral to borrow yet more stablecoins, which might go into Vault C (such as mHYPER). These tokens again become collateral, and so the cycle repeats. The same underlying pool of stablecoins gets wrapped, re-wrapped and re-lent across a handful of protocols. Visually impressive dashboards show higher TVL and higher yields, but the reality is a tight circular dependency: each protocol’s solvency depends on all others staying upright.

This structure looks alluring with lots of TVL and big APY numbers, but in truth it’s fragile. When xUSD is used as collateral to borrow against yUSD, and yUSD in turn is supported by positions relying on xUSD and similar tokens, you are stacking claims on the same underlying dollar. It becomes leverage on top of leverage, concentrated in a small, clubby network of protocols rather than diversified across many independent strategies.

Opaque Strategies and “Market Neutral” Marketing

If such systems were fully transparent, they might still be manageable. In practice, many vaults advertise “transparency” yet provide only a handful of wallet addresses or UI labels. To trace the actual deployment you’d need to parse dozens of positions, multiple chains, health factors and collateral quality, something most casual depositors cannot do.

Stream Finance exemplified this as it claimed to be “the SuperApp DeFi deserves,” but for a long time its disclosures boiled down to a few Debank links. Onchain investigators found numerous highly leveraged positions, with health factors barely above liquidation thresholds. Audits and proof-of-reserve documents were promised after community pressure, rather than being built-in features. This complexity reintroduces the same trust problem DeFi was supposed to eliminate: yes, the data is onchain, but only a small amount of people can reasonably interpret it—thus most retail users end up trusting the operator’s risk management.

Misaligned Incentives in Yield Chasing

So why build such a fragile system? Because the incentives line up as protocols are rewarded for high TVL and high APY, which attracts deposits, venture capital and narrative momentum. Managers and strategy designers earn fees based on assets and performance, so they have every reason to amplify yield. One of the fastest ways to show yield is by leveraging collateral across protocols: your token backs someone else’s vault, their token backs yours, borrowing flows both ways.

On paper, everyone looks bigger, everyone’s yield looks higher. But the casual depositor often does not share the same risk appetite. A DeFi veteran may know that a “market-neutral” vault can still blow up via cascading liquidations if correlations move or liquidity disappears; a retail user reading a simple stablecoin yield pitch is likely to believe “market-neutral” means “low risk”. That mismatch is the moral hazard: insiders harvest the upside of complex leverage while users unknowingly assume all the risk.

The Unwind and What It Signals

Stream Finance’s loss and freeze of withdrawals is the wake-up call. That one major node in the loop has halted operations and disclosed a massive deficit signals a fundamental shift: the daisy chain’s risk/reward profile has flipped. Once the smart money quietly pulled back and protocols began publicly unwinding exposures to xUSD and yUSD, the loop began to crack. Withdrawals accelerated, and teams that had previously relied on vague marketing now have to publish insurance funds, clarify which positions are “protocol-owned” versus user-owned, and issue proof-of-reserve commitments. In short, the vulnerability that was theoretical is now real.

For retail investors, the lesson is clear: if you’re looking at a stablecoin yield vault offering 10-20% and the explanation of how yield is generated is vague; if the strategy depends on looping across other yield tokens; if the marketed risk appears low while the mechanics are opaque—then you might already be inside a daisy chain. In that scenario, the risk is not just “my protocol fails” but “someone else in the loop fails and drags me down too.” The fact that Stream Finance and several other protocols are now in trouble underscores that.

In the pursuit of yield, remember that complexity and high returns often go hand in hand. When yield depends on mutual dependencies rather than fundamentals, that’s when DeFi begins to look less like decentralized innovation and more like musical chairs where the stakes are hidden until the music stops.

TL;DR

YO is safe from the Balancer V2 exploit.

YOvember is here, and big things are coming.

Transparency + recursive lending discussions abound.

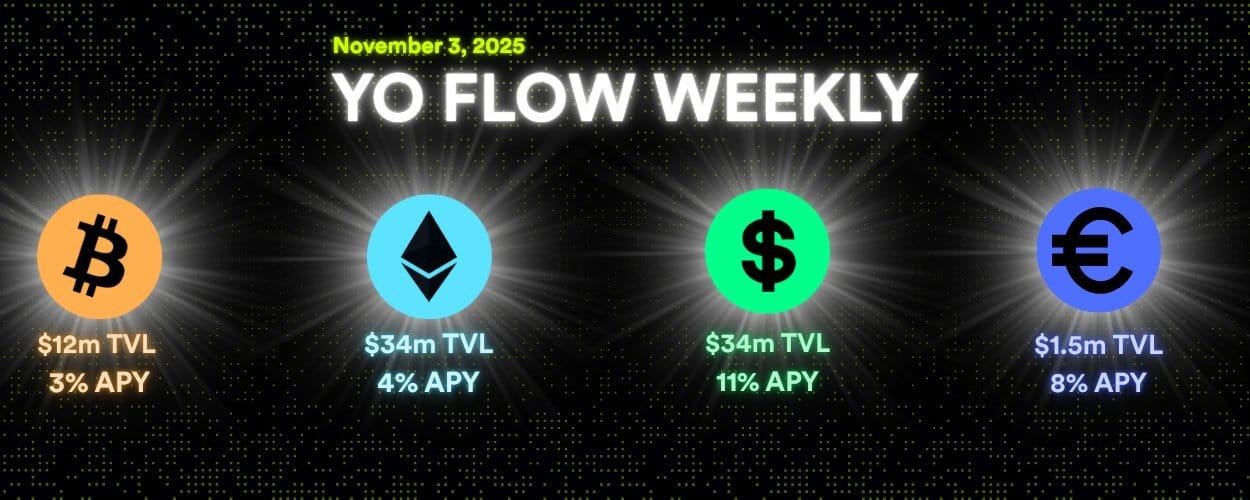

yoUSD crosses $30m TVL.

Earn Tuyo + YO points with Tuyo's new points program.

DL Research + YO space on Gen 3 yield optimizers.

YO is now live on HyperEVM.

We want to hear from you! 🗳️What type of content would you like to see more of in Edge? Your feedback helps us create content that matters to you. |

In the news 🗞️

Aave DAO makes $50 million annual token buybacks permanent. The Aave DAO has unanimously approved a proposal to allocate $50 million per year from protocol revenue to buy back AAVE tokens, cementing the program as a core part of “Aavenomics.” The initiative, which allows weekly purchases of up to $1.75 million worth of AAVE, aims to boost token value and strengthen the treasury. The move aligns with a broader DeFi shift toward revenue sharing and tokenholder returns, seen in projects like Hyperliquid, Jito, and Lido.

ZKsync proposes utility and revenue-focused tokenomics shift. ZKsync, the Ethereum Layer 2 known for its use of zero-knowledge proofs, has announced a major update to its ZK token model that would introduce real utility and value accrual. The proposed design transitions ZK from a pure governance token into one that benefits from onchain interoperability fees and offchain enterprise licensing revenue. These revenues would fund staking rewards, ecosystem development, and a new buyback-and-burn mechanism aimed at supporting token value.

Balancer suffers $128M exploit despite multiple audits. DeFi protocol Balancer lost $128 million in a sophisticated attack that targeted its v2 vaults across multiple blockchains, including Ethereum, Base, Polygon, and Arbitrum. The exploit, believed to involve invariant manipulation, allowed the attacker to drain liquidity pools by falsifying token price inputs. Despite Balancer’s v2 contracts being audited by top firms like OpenZeppelin and Trail of Bits, the incident has raised new concerns about the limits of audits in preventing complex smart contract exploits.

Trending 📈

|

|

Let us know how we did 👇Provide your feedback on today's issue of the Exponential Edge newsletter. (1 ⭐️ - not useful at all, 5 ⭐️ - extremely useful) |