- Exponential Edge

- Posts

- Monad: Rebuilding the EVM for the High-Throughput Era

Monad: Rebuilding the EVM for the High-Throughput Era

Bringing parallel execution and Web2 speed to EVM apps

Hey Edge readers,

This week we take a look at Monad, a new L1 that has recently launched its mainnet. Read on to learn what Monad is trying to do, how it executes transactions differently, and why this approach could matter for the next wave of consumer crypto apps. As always, none of this is financial advice, but if you care about infrastructure and performance, Monad is worth understanding.

Stay sharp. 🫡

-The Exponential team

What Monad is trying to do

Disclaimer: This content should not be taken as financial advice. Always do your own research before making any investment decisions.

Monad starts from a simple observation. The EVM has become the default smart contract platform, but the chains that run it still feel like early internet speeds. Ethereum handles only a small number of transactions each second, and even the faster EVM chains hit a ceiling that feels tight for gaming, social, or real time trading.

Monad does not try to replace the EVM. It keeps full EVM compatibility and focuses on rebuilding the engine underneath. The goal is to keep the contracts, tools, and mental models that Ethereum developers already use, while pushing throughput and latency into a range that feels closer to modern consumer apps.

Origin story: HFT brains meet L1 design

Monad Labs was founded in 2022 by people with a background in high frequency trading and low latency systems. They are used to squeezing microseconds out of infrastructure and they brought that mindset into L1 design.

Having watched the Ethereum and Solana competition play out, the team leaned toward the Solana style of pushing hardware and parallel execution, but chose to stay fully EVM compatible so existing developers could come along. From day one the goal has been an L1 that feels familiar to Ethereum developers but behaves more like a modern trading system, with aggressive parallelism, careful scheduling of work, and a lot of attention to networking and storage performance, not just the virtual machine on its own.

How Monad executes faster

Most EVM chains execute transactions one by one. Monad instead executes transactions in parallel, then commits results in a simple ordered list that matches the block order. From the developer point of view, the chain behaves exactly like a normal sequential EVM, but under the hood many transactions run at the same time.

Monad does this with optimistic parallel execution. The system assumes that most transactions do not touch the same state, runs them together, and only re-executes the small number that turn out to conflict. Static analysis helps predict which transactions are likely to interfere so compute is not wasted. In practice each transaction is executed at most twice.

On top of that, Monad separates consensus from execution. Consensus nodes agree on the ordered list of transactions first. Execution happens afterward in a separate pipeline with a multi block delay. That separation gives the network room to keep blocks small and frequent for a snappy user experience, while still having enough time and compute budget to process a heavy workload in the background.

Why Monad matters

Monad is interesting because it makes a clear bet. Instead of competing with Ethereum by offering a completely different environment, it assumes the EVM will remain a common standard and tries to show how far that standard can be pushed to the limits with better systems engineering.

If the network can hit its performance goals while remaining stable and reasonably decentralized, it could open room for new classes of applications that want both EVM compatibility and something closer to Web2 speed. The open questions are the usual ones for a high performance L1, such as hardware requirements for validators, real world security under load and how the eventual fee and token model behaves once there is meaningful demand.

For now Monad is one of the more serious attempts to re imagine an EVM chain for a high throughput world. If you follow new networks and care about experimentation of new apps, it belongs on your watch list.

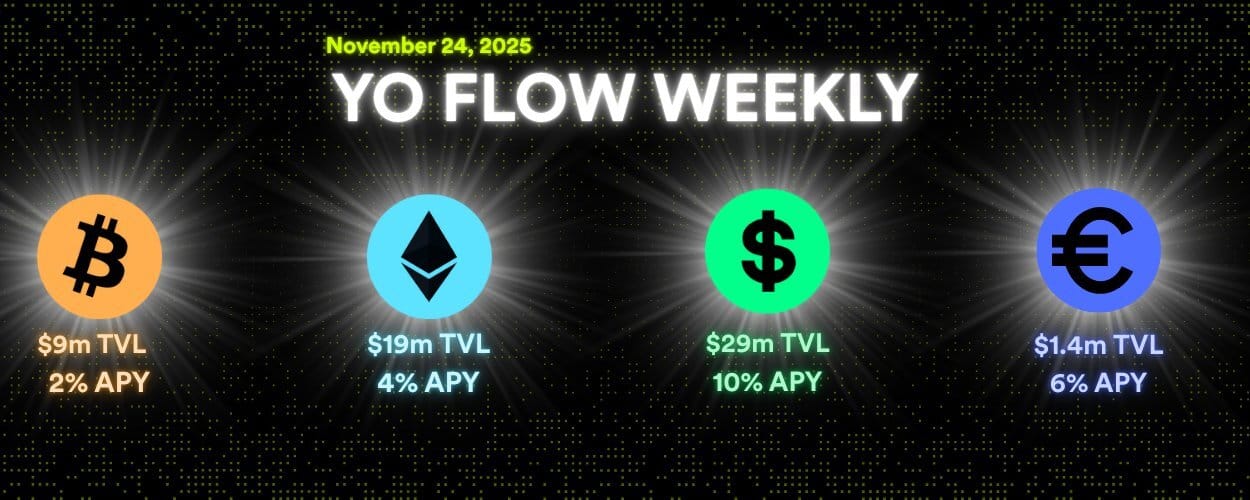

YO FLOW WEEKLY #17

TL;DR

YOligarchy open phase has concluded. A curated inner circle comes next.

YO Pendle Incentives Blitz is live: boosted APY + YO Points for LPs.

YO is hiring Web3 backend + Rust developers.

Build with YO: native Earn > non-native Earn.

We want to hear from you! 🗳️What type of content would you like to see more of in Edge? Your feedback helps us create content that matters to you. |

In the news 🗞️

Monad token soars 78% following launch excitement. MON is trading well above its $0.025 ICO price after mainnet launch, pushing valuation near $4B and leaving early ICO participants up millions as a broader market rebound led by Bitcoin adds momentum. Backed by Paradigm, Coinbase Ventures and Dragonfly, the EVM-compatible chain has already processed over 3M transactions from 140,000 addresses and seen more than 18,000 smart contracts deployed, though past launches like Plasma and Berachain show how quickly overheated valuations can unwind.

Crypto leverage hits record high in Q3 as DeFi lending dominance reshapes market structure. Galaxy Digital reports total crypto collateralized borrowing climbed to $73.6B last quarter, with onchain lending now 66.9% of all debt and DeFi loans at a record $41B as new collateral types, incentives and activity on emerging chains like Plasma drive growth. Overall leverage appears better collateralized and more transparent now than in the 2021-2022 cycle.

Hyperliquid unveils HIP-3 growth mode, slashing fees by 90% to boost new markets. The onchain perps DEX’s new feature lets anyone permissionlessly deploy markets with taker fees cut from 0.045% to as low as 0.0045% on new listings, aiming to deepen liquidity and expand its asset lineup. Growth mode requires deployers to set a fee scale between 0 and 1 and list assets that do not overlap with existing validator operated perps, while settings are locked for 30 days to prevent “parasitic” volume and keep markets stable as Hyperliquid pushes to compete with CEXs.

Trending 📈

Let us know how we did 👇Provide your feedback on today's issue of the Exponential Edge newsletter. (1 ⭐️ - not useful at all, 5 ⭐️ - extremely useful) |