- Exponential Edge

- Posts

- Is the Crypto Cycle Over, or Just Warming Up?

Is the Crypto Cycle Over, or Just Warming Up?

After rate cuts and a choppy September, we unpack where the cycle stands and what Q4 might bring.

Hey Edge readers,

Crypto pulled back this past week, leaving many wondering: did the bull market already peak, or are we simply catching our breath before the final push? With the Fed cutting rates, stocks at all-time highs, and Bitcoin stuck around $110K, it’s fair to ask where we stand. Today, we’ll unpack what’s driving markets and what to watch as we head into Q4. Check it out.

Stay sharp. 🫡

-The Exponential team

Disclaimer: This content should not be taken as financial advice. Always do your own research before making any investment decisions.

The cycle in context

Disclaimer: This content should not be taken as financial advice. Always do your own research before making any investment decisions.

First, let’s quickly recap the crypto cycle one more time. Crypto often moves in four-year cycles: years of growth followed by a sharp reset, then recovery. Historically, these cycles peak with a burst of euphoria, prices running far and fast before cooling off. This time, we’ve seen steady gains but not that “blow-off” top yet. That’s why some believe the cycle still has room left, while others think the high may already be in.

Why markets dipped

The Fed’s rate cut should have been “good news,” but markets sold off instead. Why?

Expectations: Investors had already priced in the cut.

Macro noise: Talk of a U.S. government shutdown spooked risk markets.

Leverage: Heavy trading positions unwound quickly, pulling prices lower.

The result: Bitcoin slipped about 13% from its highs, normal for crypto, where 20% swings are part of the game. Importantly, nothing broke onchain. This was more about macro jitters than a change in fundamentals.

What’s next for the cycle? 2 Possibilities

1. The late-cycle surge (the bull case)

If history rhymes, Q4 could still deliver the classic “blow-off” phase. These moves typically start with Bitcoin making new highs, but it’s ETH and altcoins that often shine brightest. In past cycles, once Bitcoin grabbed headlines, capital rotated into ETH and smaller tokens, driving some of the cycle’s fastest gains.

Imagine this scenario: BTC breaks above resistance and drags sentiment higher. Soon after, ETH catches fire as the “high-beta” play, followed by a wave of altcoins riding the momentum. This is how prior cycles ended, fast, euphoric, and crowded. With liquidity improving and Q4 historically strong, the setup is there.

2. The early top (the bear case)

There’s always a chance the peak already happened. Bitcoin has delivered a strong cycle, up several hundred percent from the lows, and a 33-month high would line up neatly with prior tops. In this case, ETH and alts could lag badly, as investors retreat to safer ground and liquidity dries up.

But here’s the catch: in every past cycle, tops came with explosive upside, a frenzy that’s hard to miss. That blow-off hasn’t happened yet. So while it’s possible we’ve peaked early, history suggests that would be unusual. Then again, history doesn’t have to repeat. It might rhyme… or break the pattern altogether.

Indicators to watch

📅 Seasonality (Q4 tailwinds)

Historically, October–December has been Bitcoin’s strongest stretch. In both 2017 and 2021, late-year surges delivered cycle peaks. September, by contrast, has often been weak, and 2025 followed that pattern with a choppy month. Entering October, the setup lines up with past late-cycle rallies.

🔄 Market rotation (the “alt season” signal)

The BTC Dominance (BTC.D) chart you see below shows Bitcoin’s share of the total crypto market. It’s currently hovering near 59%, after pulling back from the mid-60s earlier this year. In prior cycles, late-stage rallies started with BTC leading, but then BTC.D fell sharply as capital rotated into ETH and altcoins.

Notice the shaded projection in the chart: a potential move toward the low-40% range would mean a 26% drop in dominance, the kind of shift that historically accompanies “alt seasons.” If BTC breaks out and investors feel confident, ETH and alts could benefit disproportionately, just as they did in late 2017 and spring 2021. That’s why watching BTC.D is one of the clearest ways to spot whether we’re entering the blow-off phase.

🏦 Macro tone

The Fed cut rates by 25 bps in September and has signaled more cuts are likely through 2025 if inflation stays under control. Lower rates make it easier to borrow and invest, usually boosting “risk-on” assets like crypto. That’s one reason many analysts see room for upside in Q4.

Still, not everyone is convinced the ride will stay smooth. Some experts warn that cracks in growth could push the U.S. into recession next year, pointing to slowing job data, government budget battles, or weaker consumer demand. If that plays out, risk assets could face a sharp drawdown.

In short: policy tailwinds support the bull case, but the possibility of a crashout can’t be ruled out.

📊 Sentiment (neutral, not euphoric)

The Crypto Fear & Greed Index sits at 50 (neutral) as of late September. This middle-of-the-road reading means the market isn’t panicked, but also not frothy. For context, true cycle tops in the past coincided with readings above 90, when fear of missing out dominated. Neutral sentiment this close to all-time highs suggests plenty of dry powder remains if momentum kicks back in.

The bottom line

Crypto is at a crossroads: history suggests Q4 could still deliver the explosive “blow-off” move where Bitcoin leads and ETH plus altcoins shine, but risks of an early top and even a 2026 bear market remain on the table. Whether we get fireworks or fizzle, the next few months will be decisive,so stay tuned with Edge, we’ll guide you through every turn.

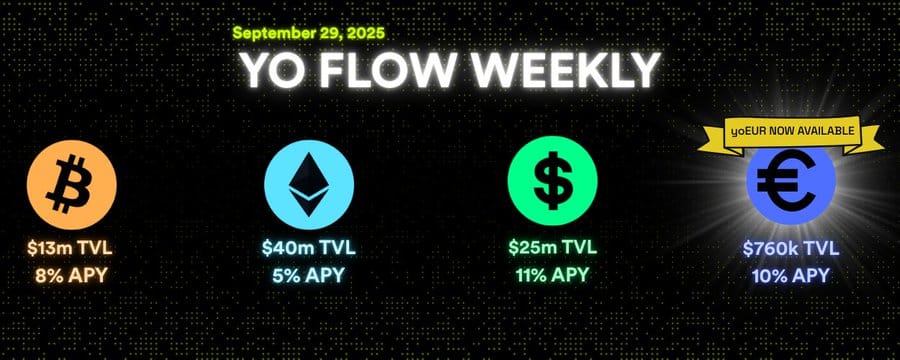

YO FLOW WEEKLY #10

TL;DR

3 vaults at all-time highs (yoUSD, yoBTC and yoEUR) 📈

Euler adds yoUSD PT collateral + looping to 38% ROE 🤯

Treasure Chest FAQ now live 🪙

Tuyo Wallet integrates YO

Pendle rollover reminder: migrate to new markets 🚨

Clearstar Fusion vault cap raised to $1m ⚛️

We want to hear from you! 🗳️What type of content would you like to see more of in Edge? Your feedback helps us create content that matters to you. |

In the news 🗞️

Plasma’s Savings Vault Attracts Almost $3B in 24 Hours: Bitfinex-backed stablechain Plasma launched its mainnet with a USDT savings vault powered by Aave and Veda, drawing $2.7B in deposits within a day and offering ~20% APY. Plasma’s TVL hit $3.4B, making it DeFi’s seventh-largest chain, while its new XPL token debuted at $1.25 with a $12.5B fully diluted valuation.

Yearn Finance Overhaul to Give 90% of Revenue to Token Stakers: A new proposal from contributor 0xPickles would overhaul Yearn Finance by directing 90% of protocol revenue to staked YFI holders, scrapping its vote-escrow model in favor of simple staking. Yearn generated just under $200K in profit last month and holds $546M in deposits, down 92% from its 2021 peak. The plan also includes DAO restructuring, stricter accountability, and contributor incentives to revive growth and align stakeholders.

Aster and Hyperliquid Drive $2Tn Volume Record as Perp DEX Competition Heats Up: Perpetual futures DEXs hit $1.8T in trading volume this quarter, surpassing all of 2024, with Hyperliquid leading overall but newcomer Aster overtaking it in daily volume at $13B. Hyperliquid, a Layer 1 with $2.7T lifetime volume, fuels growth via HYPE token buybacks, while Aster, backed by Binance co-founders’ YZi Labs, has surged 2,000% in a week and now ranks as DeFi’s second-largest revenue generator.

Trending 📈

|

|

Let us know how we did 👇Provide your feedback on today's issue of the Exponential Edge newsletter. (1 ⭐️ - not useful at all, 5 ⭐️ - extremely useful) |