- Exponential Edge

- Posts

- Inside the New Chapter for YO

Inside the New Chapter for YO

Laying the groundwork for long-term yield generation.

Disclosure: This newsletter is for informational purposes only and does not constitute financial advice. Always DYOR before making any investment.

Each week in Edge, we share data-driven insights, highlight interesting risk ratings, and showcase our latest product updates.

Let’s dive in 👇

Powering the yield engine for crypto with $YO

Last week, YO made their TGE announcement introducing $YO. Their governance token that powers how YO evolves as the yield engine for crypto. The token is aimed to formalize decision-making around how YO’s vaults, risk parameters, and ecosystem develop over time.

YO vaults are built around predefined, algorithmic strategies designed to generate stable and predictable yield. As these systems grow, their effectiveness depends on continuous calibration between how capital is allocated and how risk is managed. $YO is the mechanism that allows this process to transition from a centralized model to a decentralized one.

At launch, governance will follow a guided structure. The core team will propose direction while actively incorporating community feedback across key decisions, including vault parameters, treasury usage, revenue mechanics, and ecosystem initiatives. Over time, as governance processes mature and participation deepens, control will progressively move fully onchain in line with YO’s decentralization roadmap.

It is clear that the idea for $YO is to reflect a long-term vision rather than just a random token, and to do this, there are 2 key thing to notice:

Delayed Transferability. $YO will initially launch in a non-transferable phase where claimed tokens cannot be sold or transferred. This design choice allows governance participation to develop without short-term price incentives influencing behavior, prioritizing alignment with real users and contributors. However, transferability is expected to be enabled later via governance once the system is ready.

Long-Term Oriented Distribution. A large share of supply is allocated to community growth, future rewards, insurance, and ecosystem development, ensuring the yield engine can scale over time while keeping contributors and early backers aligned with long-term execution.

$YO Token Allocation

Right now the best way to make the most out of this announcement is by depositing into any yoVault to earn native yield plus 14% reward APY in the form of YO tokens, accruing continuously and transparently through Merkl so better hurry up!

All of this is just the tip of the iceberg for $YO, if you want to learn everything about the TGE, make sure you check out the X blog post going over absolutely everything you need to know. Check it out below 👇

New yield sources for USD and EUR

yoUSD: 🆕 yield source in Aave. The vault is now deploying USDC into the new Aave USDG lending market earning over 7.5% due to the incentivized campaign USDG has on Merkl.

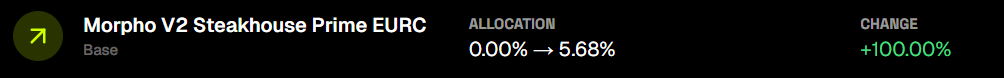

yoEUR: Taps into Morpho V2 vaults. The vault now supplies EURC into the Morpho V2 Steakhouse Prime EURC which supplies collateral to blue-chip assets like cbBTC and wstETH.

Hear from YO co-founder @Elmidou on why he launched YO and more in the latest edition of YO FLOW WEEKLY ⬇️

The latest news in DeFi land 🗞️