- Exponential Edge

- Posts

- DeFi Lending Breaks $100B

DeFi Lending Breaks $100B

ETH’s rally, shifting trust, and why lending is now DeFi’s hottest sector.

Hey Edge readers,

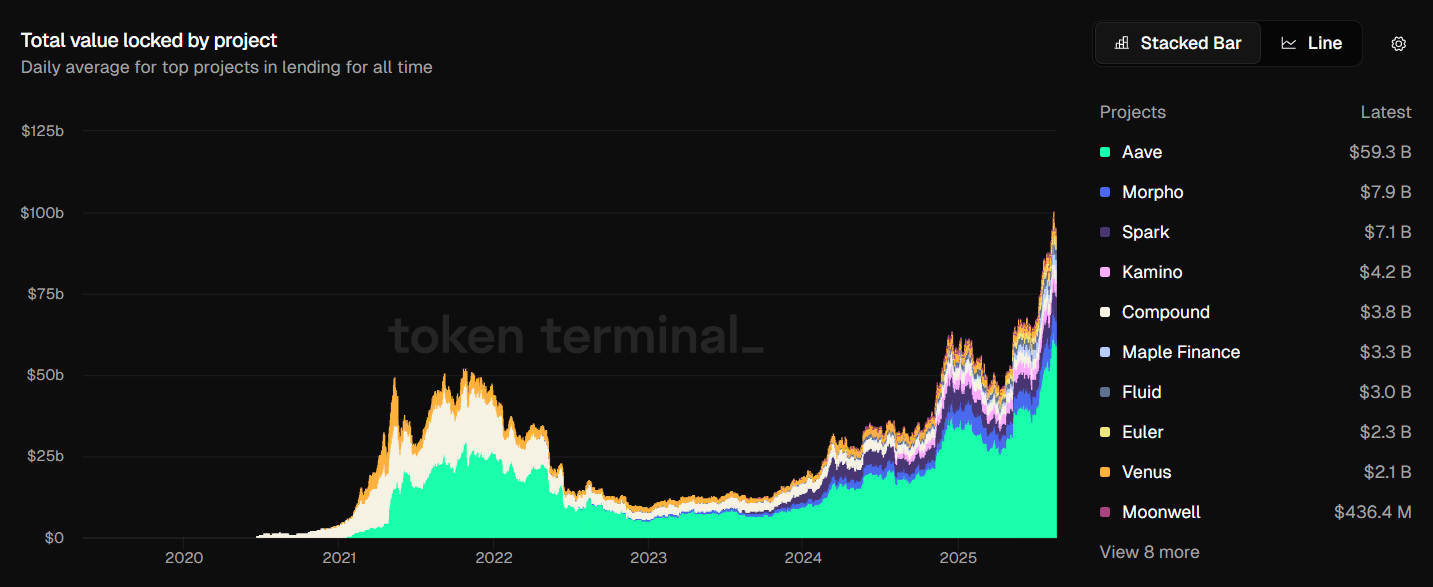

DeFi lending markets just smashed through $100 billion in total value locked (TVL), a new all-time high. Aave dominates, Morpho and Spark are catching up, and ETH’s price surge is fueling the wave. But this isn’t just numbers on a screen, it’s a story about how crypto lending is maturing into a backbone of onchain finance. Check it out.

Stay sharp. 🫡

-The Exponential team

DeFi Lending 101

For those who don’t know, DeFi lending lets anyone earn interest on their crypto by depositing it into a “pool” that borrowers can tap by posting collateral. There are different types of loans, but the most common ones are over-collateralized loans. In this type of loan, the borrower must deposit more value than they borrow (for example, $150 of ETH to borrow $100 of USDC). This protects lenders from defaults, since the collateral can be sold if its value falls too much.

That is just the tip of the iceberg, if you want to read more about how lending works in DeFi, here is our full guide on How DeFi lending works.

Lending Is Now the Biggest DeFi Sector

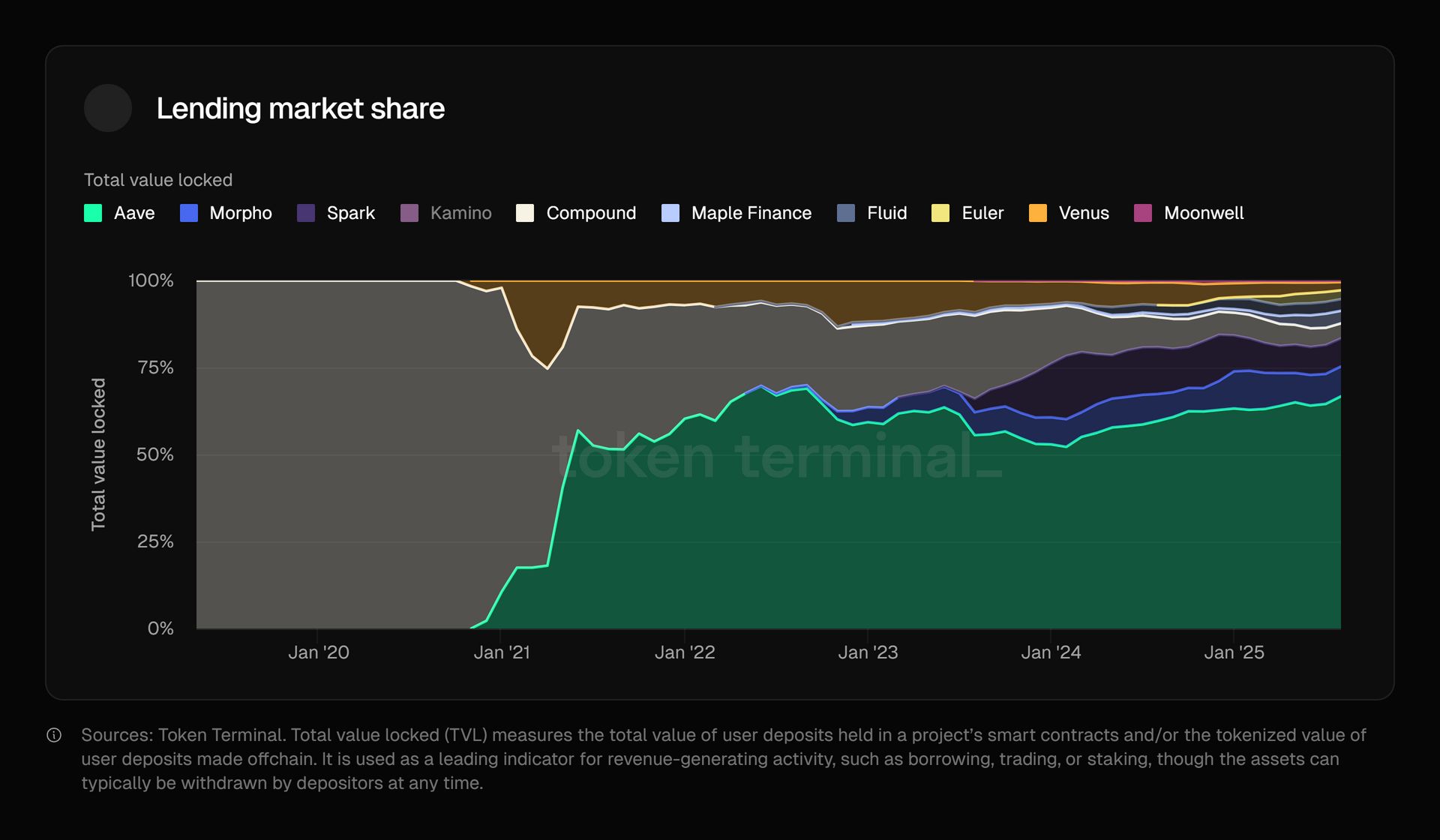

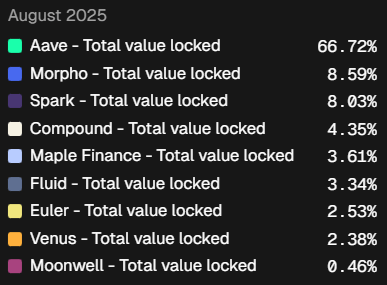

This summer, lending overtook liquid staking as the largest corner of DeFi. According to TokenTerminal, lending TVL surged from $66.8B in July to $100B in August, a 49% jump in two months. That growth now makes lending 28% of the entire DeFi ecosystem.

The catalyst? ETH’s 90% run-up since July. Because so much lending is denominated in ETH, its price rally directly inflated TVL, while also pulling in new demand for borrowing and leverage.

The Big Players and Their Innovations

Aside from Ethereum’s price appreciation, lending protocols have been building the infrastructure to make the lending space in DeFi what it is right now. Here are some of the biggest players.

Aave: Think of Aave as the “blue chip” of DeFi lending. It holds over $63B in deposits, giving it the biggest share of the market. To put that in perspective, Aave would rank as the 38th largest bank in the U.S. by assets, ahead of well-known regional banks like SouthState Bank and Valley National Bank.

Aave made lending more flexible by letting users choose between stable or variable rates, and even introduced “flash loans”, instant loans that traders can use and repay in the same transaction.

Morpho: Instead of pooling everyone’s money like Aave, Morpho tries to match lenders and borrowers directly. This way, borrowers often get lower interest rates and lenders earn more. It’s also powering other apps, like Felix, which uses Morpho’s system to run its own lending markets.

Spark: Built out of MakerDAO, Spark focuses on lending and borrowing stablecoins like DAI. It’s designed for people who want predictable, dollar-based borrowing without the ups and downs of more volatile assets.

Others: Maple has carved out a niche by offering credit to institutions, while Euler is a comeback story, bouncing back with over $1B in deposits after a major hack in 2023. These show the diversity and resilience in the lending space.

More Factors to Consider

One last thing to consider to understand the boom is trust and maturity. When centralized lenders like Celsius and BlockFi collapsed, users shifted to DeFi, where smart contracts and onchain transparency replaced opaque balance sheets. At the same time, protocols like Aave and Morpho have grown more robust, with features like over-collateralization, automated liquidations, and more efficient lending models that make the system safer and cheaper to use. These changes have transformed lending from a niche tool for traders into the backbone of DeFi, fueling the steady growth we’ve seen.

We want to hear from you! 🗳️What type of content would you like to see more of in Edge? Your feedback helps us create content that matters to you. |

In the news 🗞️

DeFi Treasury Protocol ETH Strategy Deploys Over 50% of Its ETH for Yield: ETH Strategy has allocated over half of its 11,000 ETH treasury into yield strategies, including 2,048 ETH into Etherfi’s weETH and smaller deposits to Lido, Liquid Collective, Renzo, and Aave. The protocol issues on-chain receipt tokens as proof of reserves and aims to diversify yield sources while maintaining liquidity. Its native token STRAT, launched Aug. 13, is down 13.5% amid broader ETH declines.

Coinbase’s Base Pulls Ahead of Tron With $6.6B in DeFi Deposits: Coinbase’s Base network has overtaken Tron to become the fifth-largest blockchain for DeFi, with deposits surpassing $6.6B. Morpho leads on Base with $2.5B in deposits, boosted by a $1B Bitcoin-backed lending integration with Coinbase, while Aave ranks second. Together, Morpho and Aave account for over 60% of Base’s DeFi TVL, highlighting strong growth in DeFi lending amid a broader market rally.

Ethena Crosses $500M in Revenue as Synthetic Stablecoins Gain Ground: Ethena Labs announced its protocol has generated over $500M in cumulative revenue, with weekly revenue at $13.4M and USDe supply hitting a record $11.7B. USDe is now the third-largest stablecoin and the leading synthetic, with its market cap up 86.6% in the past month. Other synthetics like Sky Dollar and Falcon USD also posted double-digit growth, as the overall stablecoin market rose 4% in August to $277.8B.

Trending 📈

|

|

Let us know how we did 👇Provide your feedback on today's issue of the Exponential Edge newsletter. (1 ⭐️ - not useful at all, 5 ⭐️ - extremely useful) |