- Exponential Edge

- Posts

- A New Era of Yield Scarcity

A New Era of Yield Scarcity

What the current market means for your 2026 yield strategy.

Disclosure: This newsletter is for informational purposes only and does not constitute financial advice. Always DYOR before making any investment.

Each week in Edge, we share data-driven insights, highlight risk ratings, and showcase new product updates.

Let’s dive in 👇

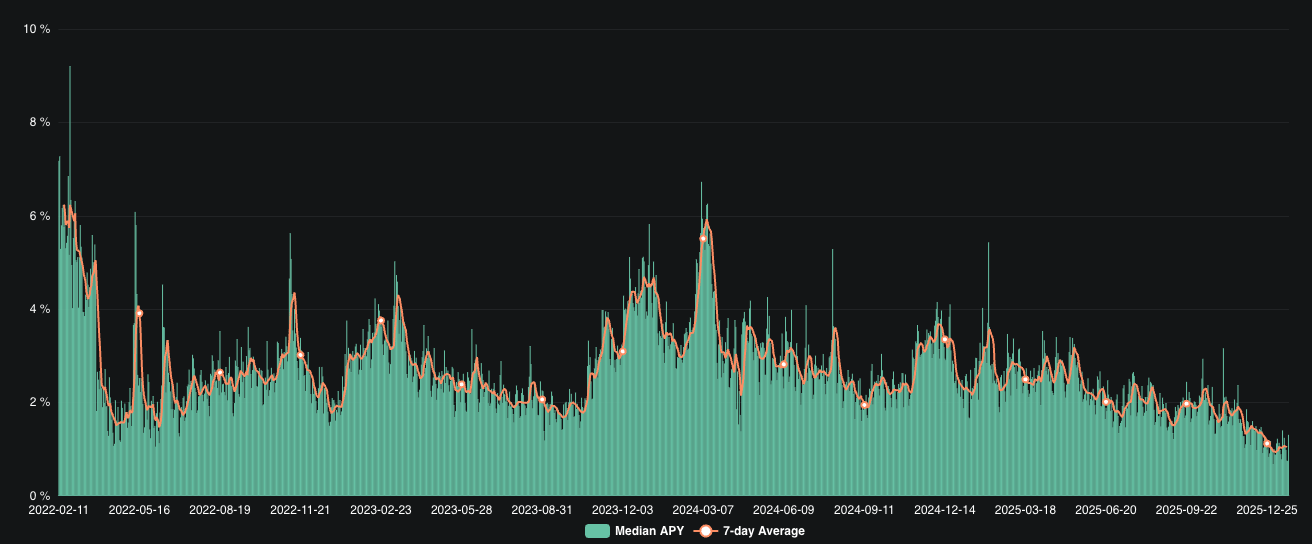

Are Low Yields Here to Stay?

Median APY trend is currently at all time lows

2025 was a record year for stablecoin supply, peaking at $310B in December. Historically, this level of liquidity signals a bull market. Yet, we are seeing a divergence with record-high supply paired with compressing DeFi yields.

Since October 2025, the market has transitioned from a high-yield environment (regularly exceeding 8-10%) to a much more depressed state. While "outlier" pools still exist, the broader market has matured. For major protocols like Aave and Morpho, average yields on stablecoins have settled into the 4-5% range, down significantly from the levels seen in late Q3 2025.

This is a result of a structural reset driven by three converging forces in 2026:

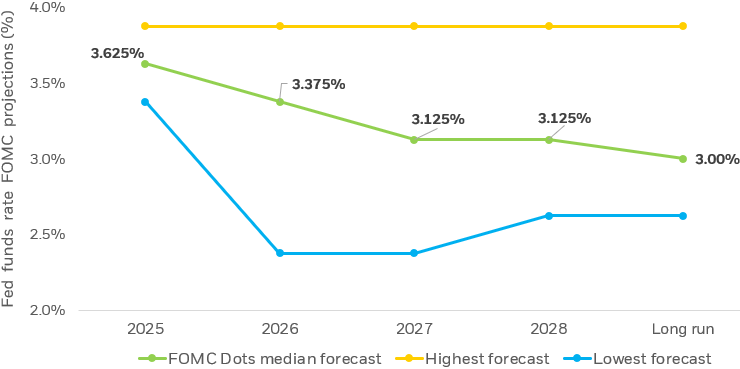

The "Fed Gravity" Effect. TradFi rates act as gravity for DeFi yields. With the Fed projected to lower the risk-free rate toward 3%, the baseline for all crypto yield has lowered. When T-Bills paid 5%, protocols had to offer 7%+ to attract liquidity. Now that the "safe" alternative is lower, the "premium" required to attract capital has shrunk.

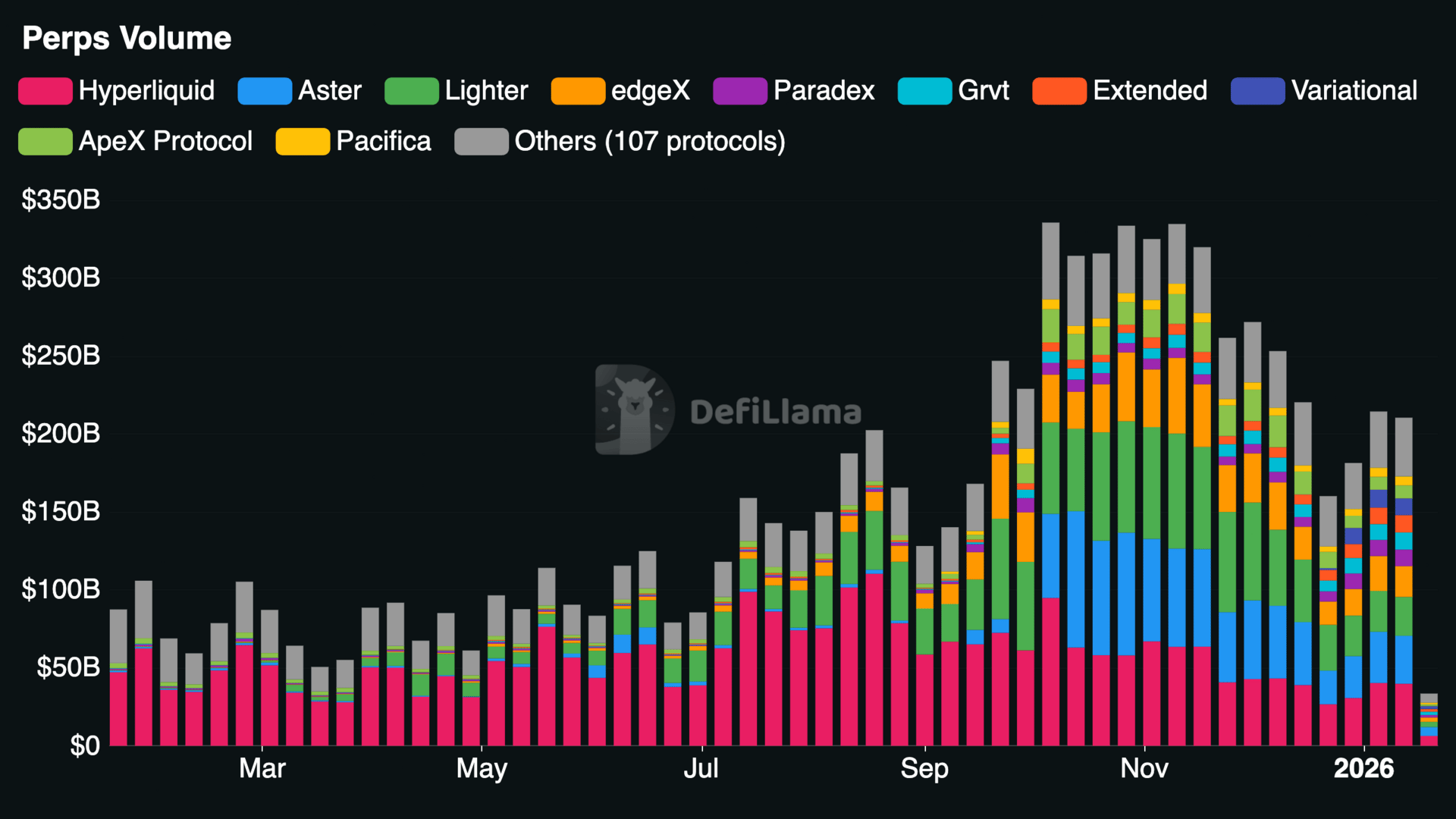

Q4 Deleveraging Event. Since the market correction in October and the exploits in November, speculative appetite has vanished. Yield is ultimately a tax on speculation. When traders stop borrowing to go long and speculate on new token launches, lending rates crash and trading volumes plummet (perp DEX volume is a useful proxy for onchain risk appetite).

Perp DEX volume down >50% from October’s peak

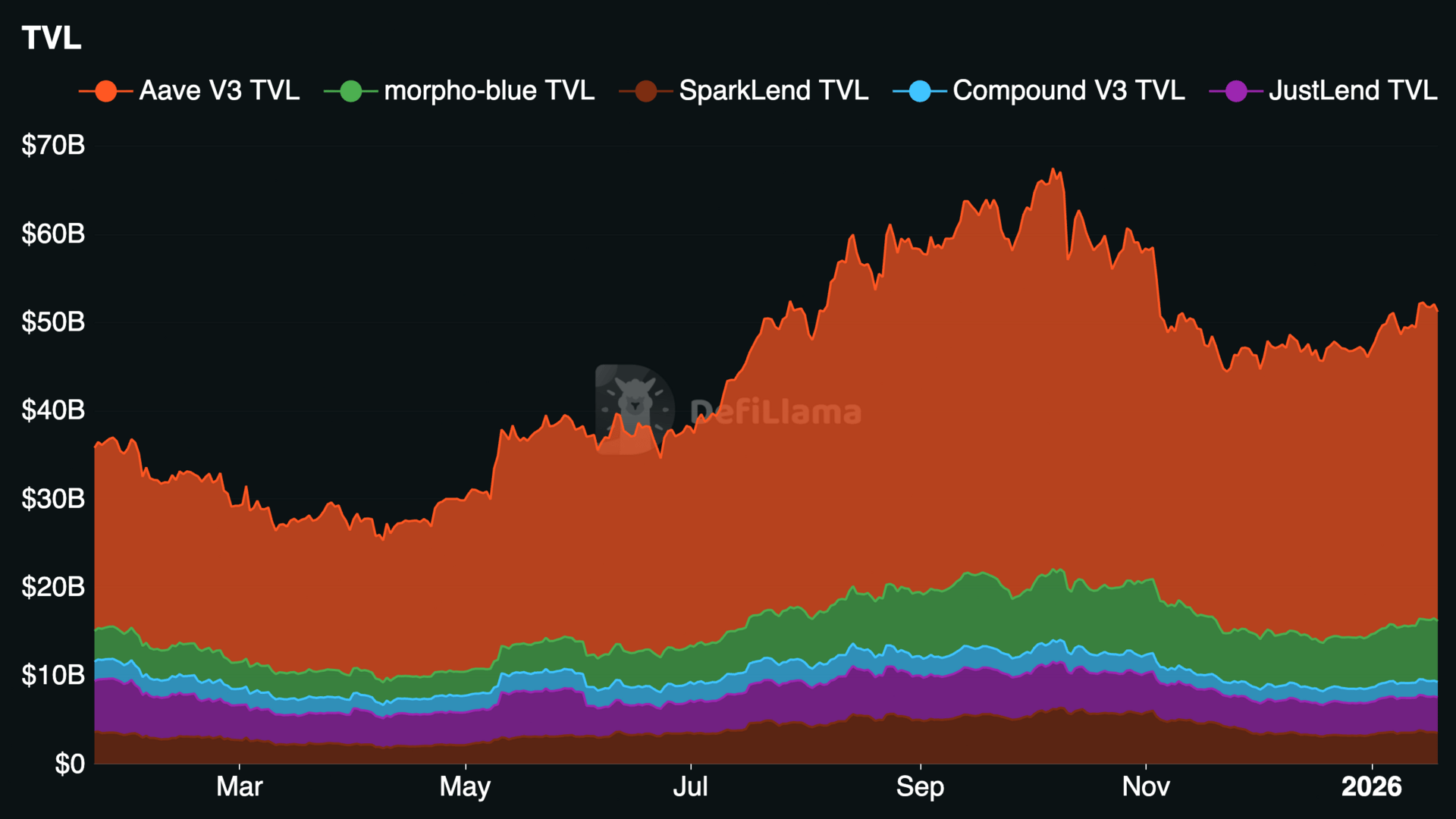

The Flight to Safety. Despite record stablecoin supply of $300B+, TVL on major lending protocols is actually down from Q3 highs. Investors have decided that 4-5% yields on Aave/Morpho no longer justify smart contract risk. As a result, capital has fled "low risk" pools and moved to the sidelines (wallets/CEXs).

With risk-free rates drifting lower and onchain leverage demand still muted, base yields will likely remain compressed in the near term. That said, attractive opportunities will continue to appear periodically (from incentive programs, liquidity shocks, volatility spikes, and new market primitives), rewarding those who can properly underwrite risk and rotate quickly to new opportunities.

High activity in yoUSD and yoETH

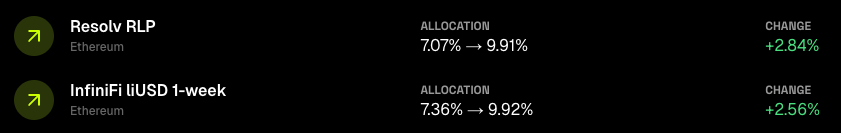

yoUSD: 🔺 Increased allocation to Resolv RLP and InfiniFi liUSD 1-week. The YO optimization engine increased allocation to Resolv RLP on Ethereum to capture higher yields following the addition of new yield sources for its delta-neutral strategies. InfiniFi also saw an uptick driven by higher fixed yields on Pendle.

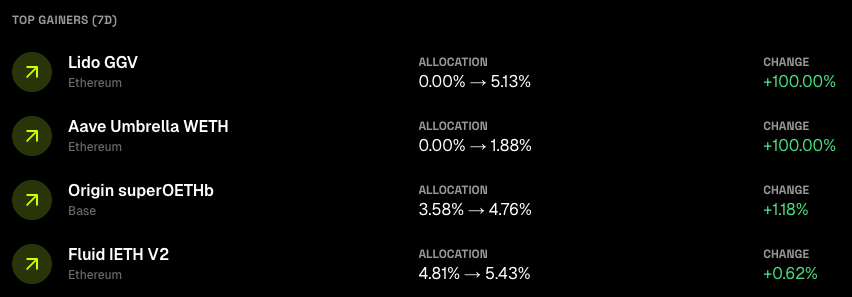

yoETH: 🆕 Added IPOR stETH Ethereum and Lido GGV to the rotation. These looping vaults takes stETH deposits and supplies it as collateral to major lending protocols, borrows ETH at conservative loan-to-value (LTV) ratios, and finally swaps it for more stETH to achieve a leveraged position on the ETH staking rate.

Something big is brewing…

Check out the latest YO Mini App on Base app.

Let us know how we did 👇Provide your feedback on today's issue of the Exponential Edge newsletter. (1 ⭐️ - not useful at all, 5 ⭐️ - extremely useful) |